Best Gold Companies To Invest In

Opening an account online is simple, and shouldn't take more than a couple of minutes, or you can work with one of their representatives to make it even simpler. When you have actually set up your account, you can fund it with a transfer, a rollover of an existing retirement account such as a 401(k), another INDIVIDUAL RETIREMENT ACCOUNT, a TSP (thrift cost savings strategy), 403(b), or 457 account, or through new contributions.

Gold, silver, platinum, palladium Gold, silver, platinum, and palladium IRARoll over existing pension, Exceptional customer service Yearly Account Cost: $75 for accounts under $100,000; $125 for accounts over, Yearly Storage Fee: $100 annually Easy to open account, Great deals of account options, Fewer academic products Advantages and disadvantages of a Gold IRA Unsure whether gold IRAs are right for you? Get the quick takeaway with these advantages and disadvantages.

How To Invest In Gold

Much of the companies we've talked about here have made a point of simplifying the procedure so that it's as easy as possible. Here's what you can anticipate: When you've picked which gold individual retirement account custodian you want to utilize, visit their site and register. They'll ask for a variety of personal identifying info and generally guide you through the procedure of establishing an account.

As soon as that's done, you're ready to buy some gold. Lots of gold individual retirement account service providers also work as precious metals dealerships and can provide you better prices on IRS-approved fine-quality gold than you might find somewhere else. If they don't use gold themselves, chances are they'll have the ability to point you in the direction of dealerships they rely on.

Best Gold Ira Companies 2021 - Gold Iras 101

Does Charles Schwab offer a gold IRA?Charles Schwab doesn't provide a gold individual retirement account, but it does use the Invesco Gold and Unique Minerals Fund, which can provide financiers with direct exposure to the rare-earth elements market by buying stocks of companies that handle mining, processing, and trading them. If you want to open a gold individual retirement account, consider among the companies above (gold 401K rollover).

Is gold a good investment right now?

Keep in mind that while the price of gold in 2021 is not what it was in the two years prior, it's still a solid investment that's likely to provide stability for the long term. If your intent for the portfolio is to provide a comfortable flow of resources during your retirement years, gold is worth your consideration.

Is gold price going to increase?

If we look from year-to-date perspective, MCX gold rate has registered 11.70 per cent rise in 2022. In spot market, yellow metal price today breached $2,000 per ounce levels, logging around 8.80 per cent rise in year-to-date time.

What will be the gold rate in 2022?

Gold rates today, 25 March 2022: Gold rates in Delhi per 10 grams of 22 carats is at Rs. 47,340 and the rate of 10 grams of 24 carats is at Rs. 51,660.

Will gold ever lose its value?

Although the price of gold can be volatile in the short term, it has always maintained its value over the long term. Through the years, it has served as a hedge against inflation and the erosion of major currencies, and thus is an investment well worth considering.

While the worth of the dollar has actually decreased over time, gold has actually shown more durable. By buying your gold through an individual retirement account instead of purchasing gold directly, you can avoid some of the taxes connected with it. That said, it's likewise essential to remember the downsides of purchasing a gold IRA.

Best Gold Ira Companies Of 2022

If you are insistent on purchasing physical gold, remember that generally diversification is considered a crucial tool for mitigating risk, so consider keeping gold as just a part of your portfolio. And if you wish to purchase rare-earth elements with more flexibility and liquidity, you might consider a gold ETF instead, which gives you exposure to gold as a property, however can be acquired through a routine pension.

The Vanguard Global Capital Cycles Fund (VGPMX) includes precious metals and mining companies, which make up about a quarter of this portfolio. If you want to purchase gold straight, you'll need to look somewhere else. Common Gold Individual Retirement Account Costs to View out for There are several costs typically associated with a gold individual retirement account.

Gold Ira Rollover Companies - Precious Metals Investing

Account Setup Charge: This is a one-time cost charged by some Individual retirement account companies when you open your account, and typically varies in between $50 and $150. Annual Custodial/Administrative Fee: Charged by your Individual retirement account for handling your account.

This is an expense that will not be associated with stocks and bonds, and will differ depending upon how much you own. Usually between $50 and $300 annually. Gold Markup: The quantity that the individual retirement account charges in addition to the spot or market value of your gold. Preferably, you'll choose a business that reveals it.

Gold Backed Ira

In a world progressively dependent on innovation, it can be assuring to know that a minimum of some of your retirement financial investments are based upon something you can see and touch. With these retirement accounts, your gold is securely custodied in a vault, and not putting swellings under your bed mattress. With any of the providers on this list, it's simple to open a brand-new account or rollover an existing IRA or another retirement account.

Keep in mind: This site is made possible through financial relationships with some of the items and services pointed out on this site. We might receive compensation if you shop through links in our content. You do not have to use our links, but you help support Credit, Donkey if you do.

Why Invest In A Gold Ira? Crash Proof

Obligation Gold's objective is to assist people safeguard their wealth and pension by diversifying and buying physical valuable metals. With over 50 years of combined experience, millions of dollars in completed transactions, leading to countless pleased customers, helped us make the most Trusted Gold individual retirement account firm in the nation.

At Allegiance Gold, we have attained the greatest possible ranking confirmed by third-party consumer protection firms. Being members of top industry watchdog groups such as the American Numismatic Association (ANA), Industry Council for Tangible Assets (ICTA) and the U.S. Chamber of Commerce supplies us with the most current insights about valuable metals.

5 Best Gold Ira Companies Of 2022 Precious Metals Ira

As an outcome, we have actually put every client on the course towards retirement preparedness. Regardless if you are a first-time financier or a skilled one, Obligation Gold's technique is developed to help you fulfill your short and long-term monetary plans. No matter what your goals may be, our objective stays the very same to help you diversify and retire more comfortably.

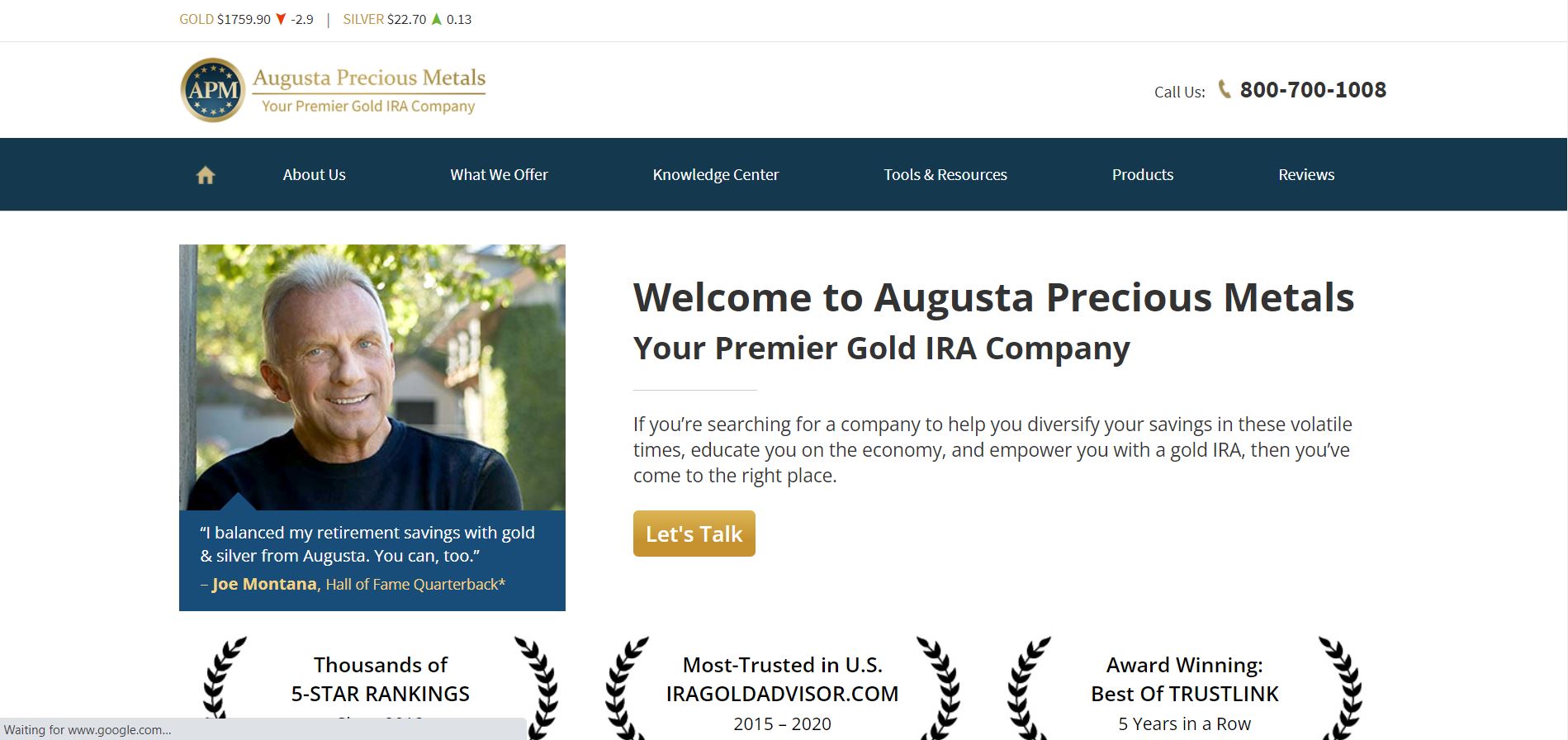

(This review page was upgraded in March 2022)Selecting the best gold IRA business is simply as important as choosing the best components to consist of in this retirement lorry. An appropriate gold individual retirement account business will supply totally free printed material relating to a gold IRA rollover that can be examined and digested. They will likewise supply a representative who can respond to all questions you might have after having evaluated the asked for materials. best precious metal to invest in 2022.

Best Gold Investment Companies

A proper Gold individual retirement account business should be a one-stop store, efficient in making all of the necessary arrangements, in order to help with a fast, tax-free, and problem-free account opening. Gold Individual Retirement Account Rollover from 401K 403B, 457BA Gold individual retirement account can be created from scratch, by utilizing funds, approximately the annual optimum contribution of $5,500 for investors under 50 years of age, or $6,500 for financiers over the age of 50.

In addition, an appropriate Gold individual retirement account company will have the ability to initiate transfers or rollovers with more unusual IRA's, like Spousal and Recipient IRA's. Benefits of a Gold Individual Retirement Account Account, The factor for producing a Gold IRA account is three-fold. First off, gold and other rare-earth elements have a history of long-lasting gratitude - etfs physical gold.

Top Gold Investment Companies: Gold Ira Company Reviews

And finally, gold and other physical rare-earth elements are the ultimate hedge against possible losses by other popular financial investments like stocks, bonds, and currencies, because traditionally speaking, when most other investment vehicles collapse or go to pieces, rare-earth elements appreciate and excel. Another remarkable benefit of a Gold backed individual retirement account is the ability to transform principal and make money from investments on a tax-free basis. gold stocks.

browse this site his explanation click for more info look at this site